Are we in a Coronavirus-inspired real estate bubble?

It’s the question on a lot of people’s minds. The real estate market’s on fire, we’ve got multiple offers on properties, and interest rates are incredibly low. There’s just so much froth in the market that a lot of people are asking themselves the big question: is the bottom going to fall out?

Well, that’s the question we’re going to get into.

Below is the Cromford Market Index.

It’s an index of how hot the market is, created by the people at Cromford to provide daily insight into the Phoenix real estate market. They’ve been doing this for a long time. They’ve predicted the booms and busts and everything in between.

Now, when the number is exactly at 100, that means the market is balanced. Everything’s essentially normal. It means that supply and demand are pretty well balanced, and that appreciation is going along slowly at 3% or 4%, which is the long-term average. But when the number goes above 100, that’s when you know the market is starting to get some heat. It’s a seller’s market. In these times, you’ll start to see multiple offers and houses will sell very quickly; however, it will be tougher for buyers. When it’s below 100, that’s a buyer’s market, like we saw in 2009 and 2010.

You can see where in 2020 the chart spiked up. We are now at 348.5, which is literally the hottest the market has ever been. Home appreciation is going up and up. We’re seeing it at ~17.5%. We’re likely going to keep seeing it behave like this until something changes, say buyers get fed up and decide that they are just going to start renting.

So, the question at hand: should this be happening in the middle of a pandemic, and what are the possible problems?

Possible Problem #1: 6.1 Million Homeowners Filed for Forbearance

So, first of all, one aspect that is coronavirus specific is that there are 6.1 million homeowners who have filed for a mortgage stay. The Black Knight Mortgage monitor just put out a report showing that of the 6.1 million homeowners who had COVID-19 related forbearance plans, 41% or 2.5 million, have since exited, with the vast majority of those currently performing. Of those who remain past due, 267,000 are inactive loss mitigation and are working out a plan with their lenders. Some of these are real potential foreclosures, and 70% of them were already past due in February before lockdown started. That being said, there hasn’t actually been that big of a change since coronavirus started.

Record levels of equity are continuing as well. People have, on average, $125,000 of equity in their home. Because of the way the market is, if you can’t make your payments on the house, you can sell it and it will fly off the market. So, it’s unlikely you’ll get foreclosed on.

Possible Problem #2: Investors are Speculating like in 2015

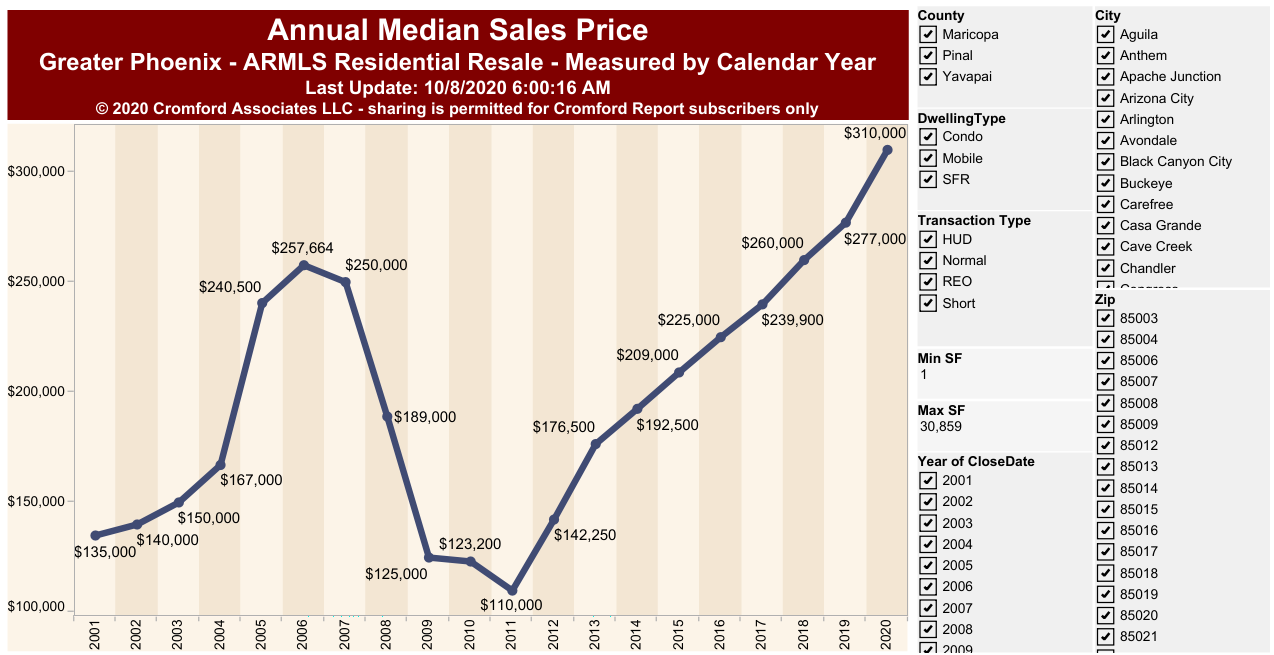

A lot of the problem in 2005 was that lots of people were buying houses and nobody lived in them. Let’s take a look some current sales and rental prices.

The way we figure out whether appreciation is happening or not is by comparing the prices of rent to the prices of a home sale. Right now, the average sale price is $310,00, which is a record high. And because they are so high, as you can see in the above chart, prices have gone up.

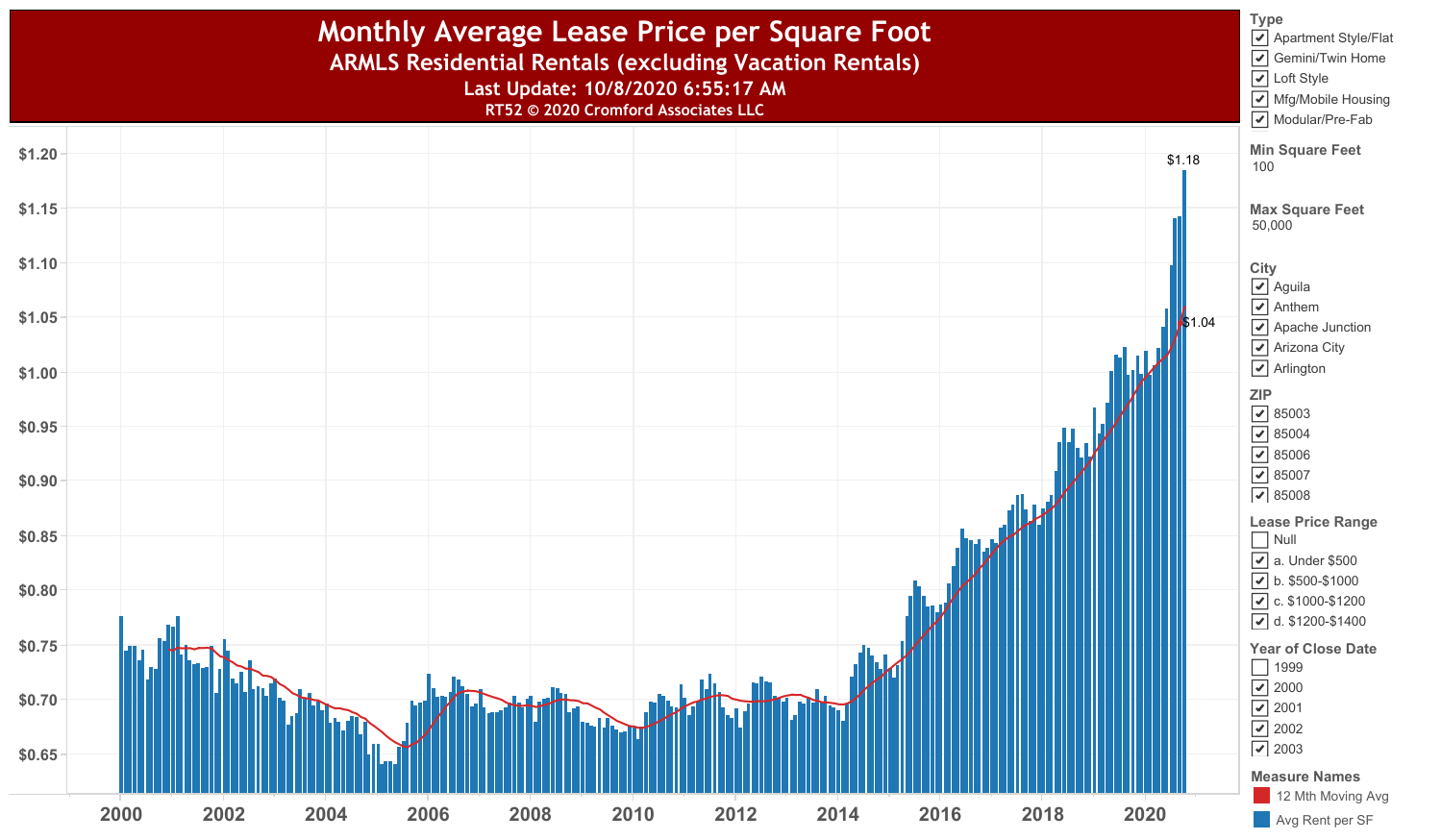

Now, if we take a look at the rental chart below, you’ll see that rents are going up too.

This is not great news if you’re trying to get a rental property, but it is great news for the market because it means that more people are buying and renting houses. It’s population growth. We get four or five calls each day with people looking to move to Arizona from out of state. The fact that people are either buying or renting means that prices are going up in both scenarios, which is not something we saw in 2008.

Possible Problem #3: Unemployment

Unemployment, while always an issue, right now has many COVID-specific factors to it. That being said, it isn’t really impacting the real estate market much, nor is it the rental market. The majority of people buying houses have jobs, and if they don’t have a job and they have to sell their house, they will be found very welcomed by this hot market.

So, is there a bubble?

Right now, it doesn’t seem like it. We’re not seeing any fundamental problems. There are some changes going on. Anecdotally, some of our clients are really having to prove in every possible way that they can afford mortgages when they apply for them and many lender’s guidelines have grown stricter. But these are not necessarily bad things for market health. Our hunch is that eventually people are just going to get kind of tired of paying more and they’re going to have to start renting because they can’t afford a place. Should this happen, affordability will get a little bit slowed down and you’ll see fewer people buying properties. At that point, the sellers who’ve been waiting around to sell, will sell. But this process will be gradual, and I d dt won’t happen overnight.

All this said, my advice to you based on what’s happening is that if you’re going to buy a house, don’t wait. It’s not going to get better. It’s costing you money every month right now that you don’t buy a house. Prices are going up.

If you’re going to sell, I wouldn’t suggest it unless you plan on doing it in the next year or two. Your home value is going to go up, so hang onto that. And right now, even though prices are higher, the cost of ownership is not as bad as it looks (if you want to learn more about that you can read here about how interest rates affect the price of real estate).

I hope this helped, and if you have any questions you can reach out to us at contact@glutchgroup.com or just comment on this post below.